Written

Author

For Madame ChristineLagarde, president of the European Central Bank, all existing Cryptocurrencies are highly speculative and risky, and she would never invest in them – as she said in this fun format. She was also promoting the arrival of the digital Euro and – of course – its backing by the ECB.

Mairead McGuinness, European Commissioner for Financial Stability, Financial Services and the Capital Markets Union, the digital Euro is if anything, a really difficult thing to process, as she said in her keynote at digifin22 in Berlin in June. At the same event, an Executive Board of the Deutsche Bundesbank, Prof. Joachim Wuermeling, stated the most important project right now, is the digital Euro.

For Manuel Lorenz, Partner at BakerMcKenzie, the biggest potential for crypto and digital currencies lies in closed settings, such as games with in-game currencies or machine-to-machine payments in pay-per-use setups.

Here smart contracts can open up new ways of value generation as long as they are bound to stablecoins.

For the digital Euro he sees three major obstacles:

This way, it will stay just a euro used mostly on the web, where it could have been a chance for new opportunities.

Piers Marais, Product Director at Currencycloud sees the 12,000 plus cryptocurrencies that there are in the world purely as an asset class – with several problems. These range from the lack of acceptance when buying goods, to a terrible user experience when dealing with coins, to a lack of trust in, and an understanding of, the technology. He admits that the initial idea of Bitcoin, that it wanted to make international transactions faster and cheaper and unite the world with a new term of value, were good.

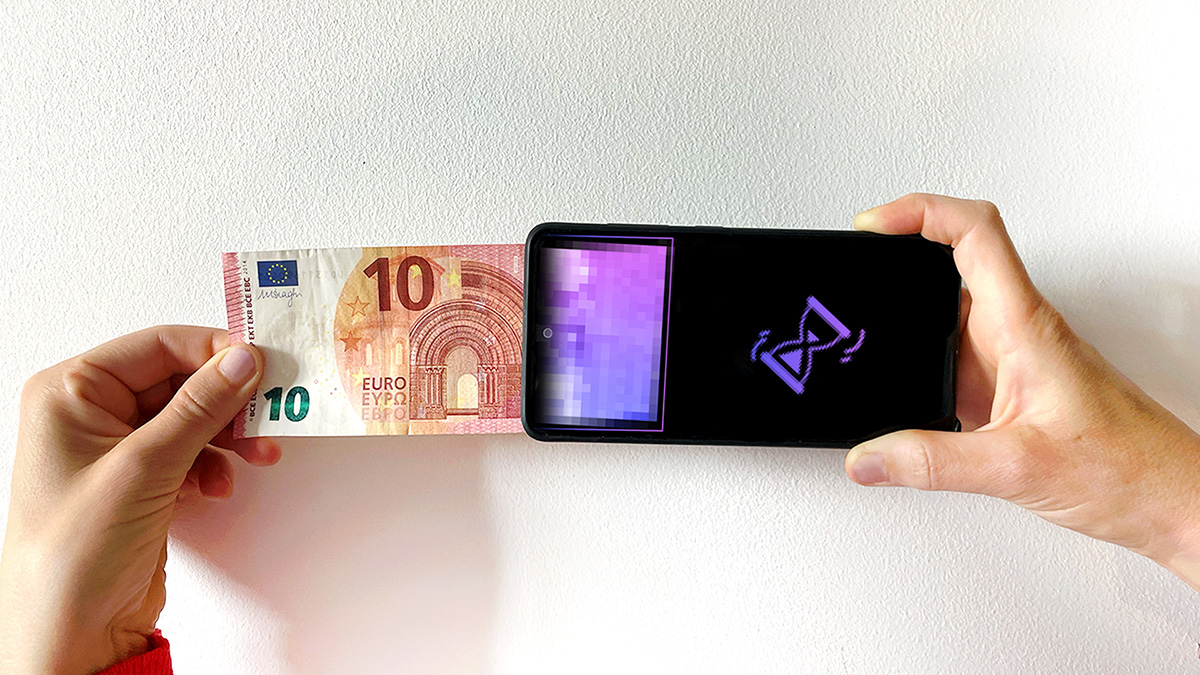

But for the execution of a truly accepted digital currency, it needs institutions like central banks, which most people trust to keep their money safe. The advantages of a digital Euro or any CBDC for businesses are easier, faster, and cheaper international transactions – that can happen regardless of office hours and across time zones. For consumers, CBDCs are an addition to the existing cash and fiat denominations – that will be actually accepted in shops – online and offline.

Could we be living in a fully digitized and cash-free world anytime soon?

The pandemic already accelerated the speed of digitization – but in most developed countries customs and structures are hard to change and things take time. Whereas emerging economies could easily leapfrog to unprecedented levels of payment technology. The timeline for the digital Euro suggests its arrival by the end of 2026 – given that bureaucracies and international cooperation works and all trials go well. So we have time to get ready and there is room for innovation! How will you adapt? And what will your bank offer?

Let us know, what you think!

Here is some additional material for you to enjoy: